Latest Facts and News

- The IRS has expanded eligibility for installment agreements in 2023

- Online payment agreements now have reduced setup fees

- Recent changes allow for longer repayment terms for certain taxpayers

- The COVID-19 pandemic has led to increased flexibility in IRS payment plans

If you are stuck in managing heaps of IRS forms, it can get tough to file taxes or follow through on IRS notices. That said, if you have already received an IRS notice about outstanding taxes, you are on their radar.

Don’t be anxious when you receive a notice out of nowhere asking you to pay a federal tax bill. But, quite frankly, ignoring it isn’t exactly a good decision. To your rescue, this problem has a solution, presented surprisingly by the IRS themselves through payment plans!

One of the many payment plan applications you will come across is Form 9465.

But, you need to stick around to learn more about questions like what is Form 9465 and other available options. We will walk you through every step of filling out the form, how to get approved without errors, and other important tips to remember.

Understanding Form 9465: IRS Installment Agreement Request

As soon as you mention back taxes to anyone, the first thing they will tell you to find out is: What is Form 9465? It’s the IRS Installment Agreement Request, which allows you to plan to pay off your unpaid taxes in divided portions.

Can Form 9465 help you?

Now that you know what is Form 9465, it’s important to determine whether it will be of any use to you.

→ Can you pay the full amount that’s due at once?

→ Will it help if the debt amount is divided into smaller payments?

→ Is your tax liability $50,000 or less (including taxes, penalties, and interest)?

If you have clear answers to the above, then you are in luck since the IRS offers two payment plan options so you can manage the payments and avoid any stricter actions:

- Short-term payment plan: This will let you settle your debt within 180 days if the amount to be paid is less than $1,00,000 in total taxes, penalties, and interest.

- Long-term payment plan (installment agreement): It gives you the option to pay in monthly installments over a maximum of six years if you owe less than $50,000.

| Friendly Reminder: File Form 9465 even if you can only afford small monthly payments. The IRS is generally more lenient with taxpayers who proactively set up payment plans before collection actions begin, and making any regular payment, even a small one, demonstrates good faith and can prevent more serious collection measures. |

Who Should Use Form 9465?

To find out if you are eligible to apply for a scheme like this, you will need more detailed information besides knowing what is Form 9465?

Here’s a checklist to help you decide:

- Owe less than $10,000: Your application can be immediately approved by the IRS in this case if you have filed returns on time in the past and no other agreements from the past five years.

- Owe less than $50,000: To be eligible for the IRS Installment Agreement, your tax debt must be less than $50,000 with all taxes, penalties, and interest.

- Able to Pay Installments: You must prove that you could pay the amount within the agreement’s timeline (usually up to six years).

- Updated Tax Returns: No pending tax returns. Everything must be up-to-date.

- Applies to Individuals or Small Businesses: Small business owners, self-employed people, or sole proprietors can also use this facility.

Use the Online Payment Agreement (OPA) at IRS.gov/OPA to pay off debts under $50,000, or get in touch with Mr. Michael Sullivan for a better understanding of your current scenario.

Also Read → IRS Tax Audit Defense

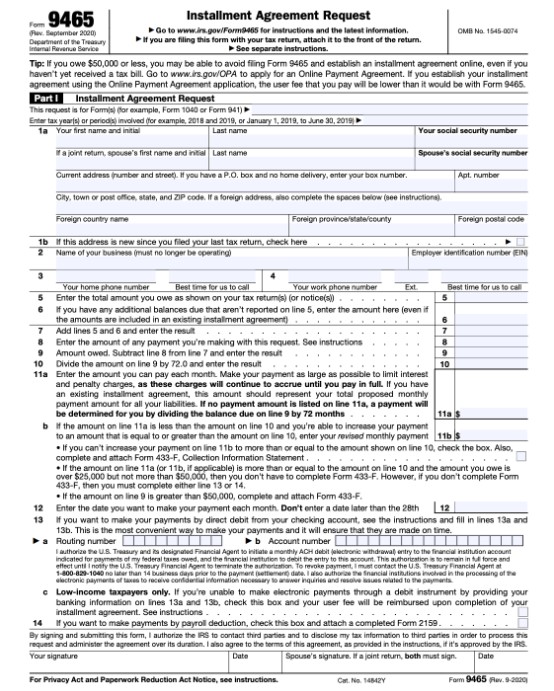

Form 9465 Instructions: How to Complete the Form?

What is Form 9465? How to fill out Form 9465? These are undeniably some very common questions in the minds of individuals and businesses. But now that we have a fair understanding of them, let’s look at how you can complete it:

Follow these steps to fill out Form 9465(Part 1):

| Line No. | Field | Details to Fill Out |

| 1a | Your name, initials, and SSN. Spouse’s name and SSN | Enter your full name, initials, and Social Security Number (SSN). If filing jointly, include your spouse’s details. |

| 1b | Change of address | Check if your address differs from the one on your last tax return. |

| 2 | Business name and EIN | Provide the name of your business (if applicable) and its Employer Identification Number (EIN). |

| 3/4 | Phone number & Alternate phone number | Enter your primary & alternate phone numbers and indicate the best time to contact you. |

| 5 | Total amount owed | Enter the total amount you owe on your tax return(s) or IRS notices. |

| 6 | Additional balances owed | Enter any additional balances not reported on Line 5. |

| 7 | Total owed | Add the amounts from Lines 5 and 6, then enter the total here. |

| 8 | Payment made now | Enter any payment you are making now along with this request. |

| 9 | Remaining balance | Subtract Line 8 from Line 7 and enter the remaining balance owed. |

| 10 | Minimum monthly payment | Divide the amount in Line 9 by 72 and enter the result (minimum monthly payment). |

| 11a | Proposed monthly payment | Enter the monthly amount you can pay if it’s more than the minimum on Line 10. |

| 11b | Future increase in payment | Check the box if you plan to increase your monthly payments later. Attach Form 433-F. |

| 12 | Payment start date | Enter the starting date for monthly payments to begin (must be before the 28th). |

| 13a & 13b | Direct debit payment (optional) | Provide your bank routing number and account number to set up automatic payments. |

| 14 | Payroll deduction payment option | Check this box if you want to make payments through payroll deduction. Attach Form 2159. |

| Sign | Authorization | Sign and date the form. If filing jointly, spouse must do the same. |

PDF of the IRS Form 9465(Part 1) Source:https://www.irs.gov/pub/irs-pdf/f9465.pdf