IRS Tax Fraud- What is Tax Fraud?

Did you know that failing to file your taxes can lead to a year in prison and fines of up to $100,000, while attempting to evade taxes could result in five years of imprisonment and a $250,000 fine? Even with these severe penalties, some individuals, corporations, and trusts still engage in tax fraud. But what is tax frauds exactly? It’s when someone deliberately misrepresents or hides their financial information to reduce their tax liability.

In this blog, we’ll break down IRS tax fraud reporting, explore the consequences, and provide tips on how to avoid getting caught up in fraudulent activities. Let’s dive into the details and help you understand the serious implications of tax fraud.

What is Tax Fraud?

Tax fraud is a serious offense where an individual or business deliberately attempts to evade tax obligations. This isn’t about innocent mistakes or oversights—tax fraud involves intentional actions aimed at avoiding paying taxes. Understanding what is IRS fraud and the implications of tax fraud is important to avoiding severe consequences.

Recognizing Tax Fraud

Tax fraud occurs when someone intentionally provides false information on a tax return to reduce the amount of tax owed. Common examples include underreporting income, inflating deductions, claiming false expenses, or not filing a tax return when required. The key element in tax fraud is the deliberate intent to mislead the IRS and avoid paying taxes.

Now that we understand how tax fraud occurs, let’s explore the serious legal and financial consequences that follow these unlawful actions.

What are the Consequences of Tax Fraud?

- Misdemeanor Offense: Failing to file a tax return or provide required information can result in up to one year in jail and fines of up to $100,000 for individuals or $200,000 for business entities.

- Felony Charge: Making false or fraudulent statements may lead to up to three years in prison and fines of up to $250,000 for individuals or $500,000 for business entities, with possible additional penalties due to prosecution costs.

Recognizing the gravity of tax fraud and the necessity for precise tax reporting is crucial for individuals and businesses to avoid severe IRS tax fraud penalties and ensure compliance with tax laws.

What the IRS Considers Tax Fraud?

- Underreporting Income: Deliberately failing to report all sources of income, such as cash payments or side earnings, to reduce taxable income.

- Inflating Deductions or Expenses: Intentionally overstating deductions or business expenses to lower tax liability, such as claiming personal expenses as business expenses.

- Claiming False Credits: Fraudulently claiming tax credits that one is not entitled to, such as the Earned Income Tax Credit or Child Tax Credit, without meeting the qualifications.

- Falsifying Documents: Creating or altering documents, such as receipts or financial statements, to mislead the IRS and support fraudulent claims.

- Concealing Assets or Income: Hiding income or assets in offshore accounts or through other means to avoid detection by the IRS.

- Failure to File Tax Returns: Intentionally not filing a tax return despite having a legal obligation to do so, especially when substantial taxes are owed.

The Role of the IRS in Tax Fraud Investigations

IRS Criminal Investigation Unit Overview:

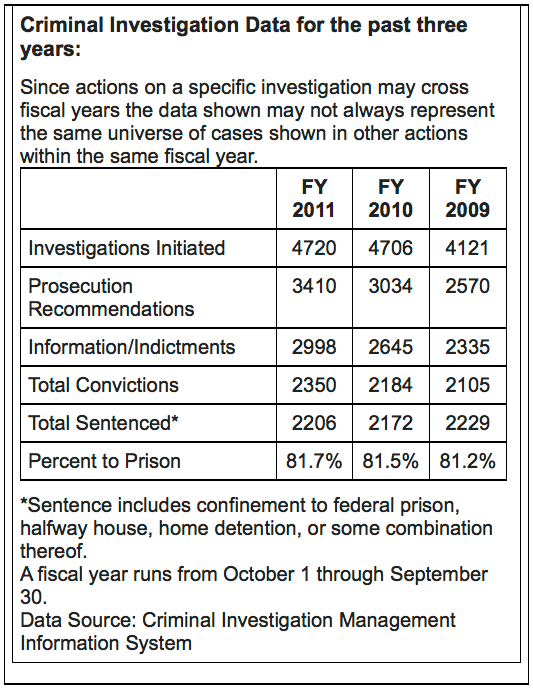

- Approximately 2,700 Special Agents: These agents have unique authority to investigate criminal violations of the Internal Revenue Code, which sets them apart from other federal agencies.

Special Agents’ Expertise:

- Advanced Forensic Technology: Special Agents are trained to recover encrypted, password-protected, or hidden financial data using sophisticated forensic tools. This capability ensures that no illegal activity goes unnoticed.

High Conviction Rates and Penalties:

- One of the Highest Conviction Rates in Federal Law Enforcement: IRS Criminal Investigation boasts one of the highest conviction rates in the federal system.

- Severe Penalties for Conviction: Convicted individuals often face substantial prison sentences, and fines and are required to pay civil taxes and penalties.

How Does the IRS Detect Tax Fraud?

- Data Matching: Comparing information reported on tax returns with data from third parties, such as employers and financial institutions, to identify discrepancies.

- Audits: Conducting detailed examinations of tax returns and supporting documents to verify the accuracy of reported information.

- Whistleblower Tips: Acting on tips received from informants about suspected tax fraud, which can lead to investigations and audits.

If you suspect you might be at risk or need guidance on IRS tax fraud reporting, don’t hesitate to contact a tax professional like MD Sullivan Tax Firm.

As a former IRS consultant, Michael Sullivan and his team have 250+ years of cumulative direct IRS experience. They also provide assistance with innocent spouse tax relief, and IRS audit reconsideration, among other tax related issues.

Types of Tax Fraud

Understanding the different types of tax fraud can help individuals and businesses avoid engaging in or becoming victims of these illegal activities.

Willful Failure to Pay Income Taxes

Willful failure to pay income taxes occurs when a taxpayer intentionally avoids paying the taxes they owe. This can involve not filing a tax return, underreporting income, or not paying the tax due by the deadline.

The key element in this type of fraud Include the following:

- Making a Frivolous Tax Claim: Frivolous tax claims involve making unreasonable or groundless claims on a tax return to reduce tax liability. These can include false deductions, fictitious expenses, or invalid credits.

Frivolous claims are often used to delay or avoid paying taxes, and the IRS imposes significant penalties on those who file them.

Employment and Payroll Tax Fraud

Employment and payroll tax fraud involves schemes where employers or payroll service providers underreport workforce numbers or fail to remit payroll taxes, such as federal unemployment, Social Security, and withholding taxes, to the IRS. Common tactics include:

- Employment Leasing: Employers outsource payroll responsibilities to a third party that collects but does not remit employment taxes, eventually disappearing when confronted by the IRS.

- Pyramiding: Business owners withhold payroll taxes from employees’ wages but do not forward the taxes to the IRS, pocketing the funds instead.

- Cashing Out: Employers pay workers in cash to avoid reporting income and paying payroll taxes, allowing them to falsify payroll records and underreport tax liabilities.

Refund Fraud

Refund fraud occurs when individuals or tax preparers file false tax returns to claim unearned tax refunds. This can involve:

- Identity theft

- Fabricating deductions

- Inflating expenses to increase the refund amount

The IRS actively investigates and prosecutes refund fraud, as it can result in significant losses to the government.

Abusive Tax Schemes

Abusive tax schemes involve complex arrangements designed to hide income or assets from the IRS.

- These schemes often exploit offshore tax havens or involve failing to file required reports.

- Those are such as the Foreign Bank Account Report (FBAR) and the Foreign Account Tax Compliance Act (FATCA) disclosures.

While some taxpayers may unknowingly engage in these schemes, the IRS views them as deliberate attempts to evade taxes.

Tax Preparer Fraud

Tax preparer fraud occurs when tax professionals manipulate clients’ tax returns to generate larger refunds and pocket the excess funds.

Common tactics include:

- Fabricating deductions

- Inflating expenses

- Falsifying credits

Tax preparer fraud not only harms the IRS but also exposes clients to potential audits and penalties. The IRS actively prosecutes tax preparers involved in fraudulent activities.

The IRS CI unit monitors signs of IRS tax fraud, including discrepancies in reported income, suspicious financial transactions, and fraudulent tax return filings.

It is essential for individuals and businesses to maintain accurate records, file honest tax returns, and seek professional advice when needed to ensure adherence to tax laws.

In case you are facing a tax fraud challenge, you can consult Mr. Michael Sullivan. He can guide you through the best tips to avoid tax fraud.

He has a team of expert IRS consultants who also provide additional services like IRS debt forgiveness programs and IRS tax debt settlement help.

Tax Fraud vs. Negligence or Avoidance: What is the difference?

| Aspect | Tax Fraud | Negligence | Tax Avoidance |

| Definition | Deliberate falsification or concealment to evade taxes | Failure to exercise due care or reasonable diligence | Legal planning to minimize tax liability |

| Intent | Intentional | Unintentional; due to oversight or carelessness | Intentional but within legal boundaries |

| Common Examples | Underreporting income, claiming false deductions | Simple errors in reporting, forgetting to include income | Using tax deductions and credits as allowed by law |

| Consequences | Severe penalties, including criminal charges, fines, and imprisonment | Penalties and interest on unpaid taxes; no criminal charges | Legal tax benefits; no penalties if correctly applied |

| IRS Action | Investigated by IRS Criminal Investigation unit | Typically handled by IRS audits or adjustments | Accepted as long as it adheres to tax laws |

| Example of Behavior | Creating fake documents, hiding assets | Misreporting income due to error in calculations | Investing in tax-advantaged accounts |

These differences help in managing tax responsibilities and avoiding legal issues. Tax fraud involves intentional deceit and severe consequences, whereas negligence is usually a result of oversight, and tax avoidance is a legal method for reducing tax liability.

IRS TAX FRAUD- WHAT IS TAX FRAUD?

VIOLATIONS, FINES AND PRISON SENTENCES

Title 26 USC § 7201

Attempt to evade or defeat tax

Any person who willfully attempts to evade or defeat any tax imposed by this title or the payment thereof shall, in addition to other penalties provided by law, be guilty of a felony, and upon conviction thereof:

- Shall be imprisoned not more than 5 years

- Or fined not more than $250,000 for individuals ($500,000 for corporations)

- Or both with the costs of prosecution

Title 26 USC § 7202

Willful failure to collect or pay over tax

Any person required under this title to collect, account for, and pay over any tax imposed who willfully fails to collect or truthfully account for and pay over such tax shall, in addition to penalties provided by the law, be guilty of a felony:

- Shall be imprisoned not more than 5 years

- Or fined not more than $250,000 for individuals ($500,000 for corporations)

- Or both with the costs of prosecution

Title 26 USC § 7203

Any person required under this title to pay any estimated tax, make a return, keep any records, or supply any information, who willfully fails to at the time required by law, shall, in addition to other penalties provided, be guilty of a misdemeanor, and upon conviction thereof:

- Shall be imprisoned not more than 1 years

- Or fined not more than $100,000 for individuals ($200,000 for corporations)

- Or both with cost of prosecution

Title 26 USC § 7206(1)-Declaration under penalties of perjury

Fraud and false statements

Any Person who willfully makes and subscribes any return, statement, or other document, which contains a written declaration that is made under the penalties of perjury, and which he does not believe to be true and correct as to every material matter; shall be guilty of a felony, and upon conviction thereof:

- Shall be imprisoned not more than 3 years

- Or fined not more than $250,000 for individuals ($500,000 for corporations)

- Or both with cost of prosecution

Title 26 USC § 7206(2)- Aid or assistance

Fraud and false statements

Any person who willfully aids or assists in, or procures, counsels, or advises the preparation or presentation of a return, affidavit, claim, or other document, which is fraudulent or is false as to any material matter, whether or not such falsity or fraud is with the knowledge or consent of the person authorized or required to present such return, affidavit, claim, or document; shall be guilty of a felony and, upon conviction thereof:

- Shall be imprisoned not more than 3 years

- Or fined not more than $250,000 for individuals ($500,000 for corporations)

- Or both with cost of prosecution

Title 18 USC § 371

If two or more persons conspire either to commit any offense against the United States, or to defraud the United States, or any agency thereof in any manner or for any purpose, and one or more of such persons do any act to effect the object of the conspiracy, each:

- Shall be imprisoned not more than 5 years

- Or fined not more than $250,000 for individuals ($500,000 for corporations)

- Or both

How to Report IRS Tax Fraud?

- Gather Information: Collect all relevant details about the fraud, including names, addresses, and a description of the fraudulent activity. The more information you provide, the more helpful your report will be.

- Complete Form 3949-A: This is the official form used to report suspected tax fraud. You can download it from the Internal Revenue Service (IRS) website or request it by mail.

- Submit the Form: Send the completed Form 3949-A to the address specified on the form. You can choose to remain anonymous, but providing your contact information may help the IRS if they need additional details.

- Use the Whistleblower Office: If the potential fraud involves a significant amount of unpaid taxes, you might consider reporting it through the IRS Whistleblower Office, which offers potential rewards for valuable information.

- Follow-Up: While the IRS doesn’t provide updates on investigations, ensuring your report is thorough and accurate increases the chances of effective action being taken.

Follow the steps for IRS tax fraud reporting; this way you can help the IRS identify and address tax fraud, contributing to a fairer tax system.

How to Protect Yourself from Tax Fraud?

1. Safeguard Personal Information:

Keep your Social Security number (SSN) and other personal information secure. Avoid sharing sensitive details via email or phone unless you are certain of the recipient’s identity.

2. Monitor Financial Accounts:

Regularly check your bank accounts, credit card statements, and credit reports for any suspicious activity or unauthorized transactions.

3. Use Secure Methods for Filing Taxes:

File your taxes electronically through secure, reputable platforms. If filing by mail, send your returns directly from the post office.

4. Be Wary of Scams:

Beware of phishing emails, phone calls, or texts claiming to be from the IRS. The IRS will never contact you through these methods to demand immediate payment or personal information.

5. Shred Sensitive Documents:

Properly dispose of any documents containing personal information by shredding them.

6. Report Suspicious Activity:

If you suspect you’ve been a victim of tax fraud, report it immediately to the IRS and other relevant authorities.

By following these steps, you can significantly reduce the risk of becoming a victim of tax fraud.

Final Words!

The consequences are severe, ranging from hefty fines and interest to imprisonment and asset seizures. Remember, tax fraud isn’t just a financial misstep; it’s a serious crime with long-lasting repercussions.

For expert assistance and guidance on preventing and dealing with tax fraud, contact Michael Sullivan, a trusted professional in tax matters. Ensure your financial security and compliance with the IRS by seeking advice from an experienced specialist.