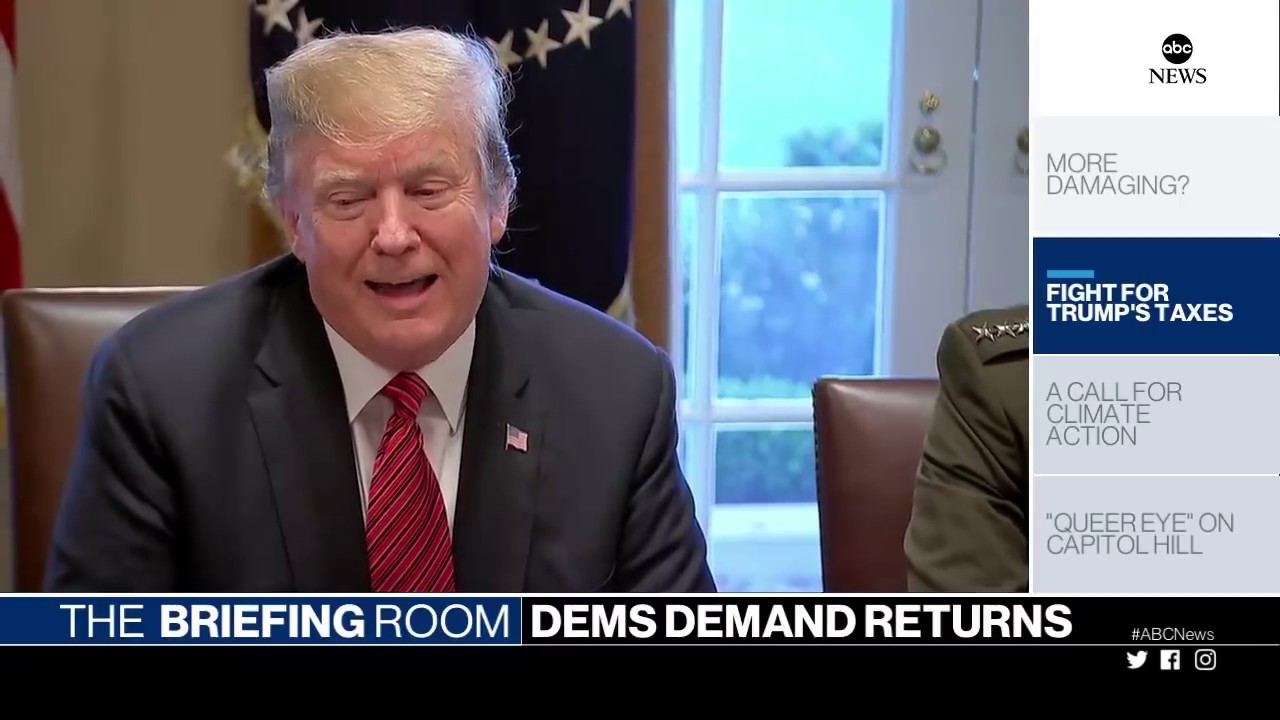

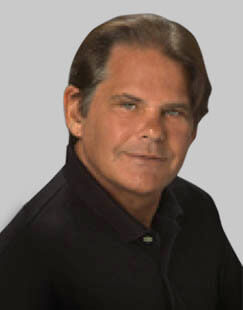

Michael D. Sullivan is the creator of MD Sullivan Firm Tax Group. He has made appearances on Fox Business News, ABC’s “The Briefing Room,” NEWSMAX, NEWSNATION, NTD, and other national broadcasts. Some of his interviews can be found on our page. The MD Sullivan Firm Tax Group boasts exceptional practitioners nationwide.

Michael spent a distinguished decade as an Internal Revenue Service employee. As a seasoned IRS Revenue Officer/Agent, he specialized in Offer in Compromise Tax cases and handled significant dollar-value cases. He even collaborated with the U.S. Attorney’s office on covert operations. Michael’s exceptional work as an IRS Agent earned him numerous awards.

During his tenure at the IRS, he served as a Certified Tax Instructor, teaching at the Atlanta Regional IRS Training Offices as well as local and district offices.

Mr. Sullivan played a crucial role in training new IRS Agents and taught the Offer In Compromise Program.

For the past 40 years, Michael has operated a private practice focused on consulting taxpayers on IRS Audit and Collection tax resolution matters. He has successfully handled numerous complex cases for affluent individuals and large corporations.

Mr. Sullivan is deeply committed to the tax profession community and has actively participated in the South Florida circuit as a frequent speaker. He has served as an officer and board member of the Greater South Florida Tax Council.

Michael has hosted and moderated various Internal Revenue Service forums in both public and professional sectors.

He administers a Facebook Group with 4100 members called “IRS Representation, HELPFUL TAX TIPS TO SOLVE IRS PROBLEMS” and owns a YouTube Channel called “@HELP FROM A FORMER IRS AGENT,” which has amassed over 7000 subscribers and 300,000 watch hours.

Additionally, he is the founder of the TAX MOB GROUP which is the home of 300+ tax professionals specialized in Tax resolution services.

He loves his profession and is a true “giver”.